Life Hacks

I like puzzles and optimization. This is a collection of things I’ve found at the intersection of those topics. Note that the finance-related advice here is mostly for US residents.

Index

- Big Picture Life Planning

- Personal Finance

- Healthy Eating

- Sleep

- Tech Security & Privacy

- Clothing

- Death Planning

- Random

Big Picture Life Planning

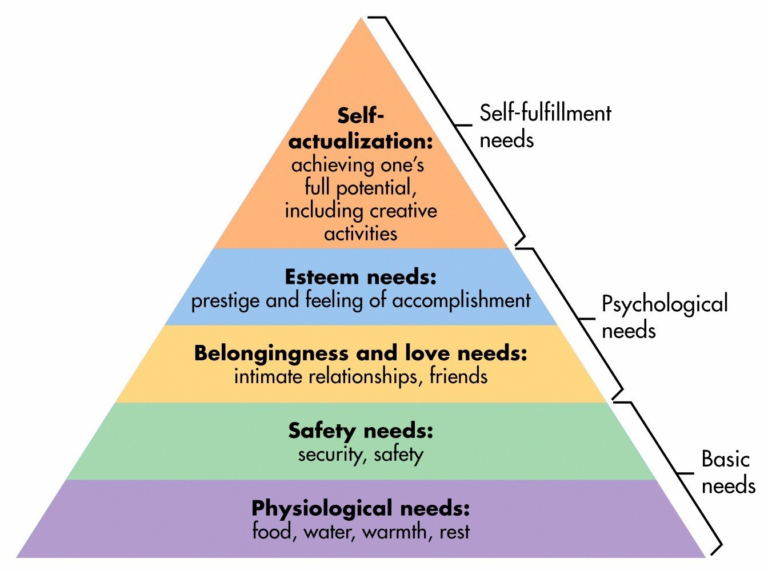

The closest thing I have found to a blueprint for big picture life planning is Maslow’s Hierarchy.

Personal Finance

Why Care About Personal Finance?

Why spend time thinking about your finances? And why do people even attempt the difficult task of saving money? The answer is most people don’t want to work for their entire lives. They eventually wish to retire, or switch to a leisurely job of their choice. So if retirement (alternatively called “financial independence”) is why managing your finances is important, then understanding where this “finish line” sits is important, otherwise you may never reach it (or pass it by without noticing). Even if you love your current job, having the option of retiring is a nice plan B, especially if you imagine where you will be at age 75 or 95, or if your life circumstances suddenly change.

Retirement can be defined as the point when your investment returns fully cover your expenses. I recommend the 4% rule for a longer discussion about this. Most research indicates that the 4% number is reasonably conservative (4.5% might be fine, though is less conservative). To calculate your retirement savings target, you need to know (or estimate) your annual spending. Determining this number should be one of your first steps.

Let’s try this with some example numbers. If you spend $24,000 per year (or $2,000 per month), then you need $24,000 / 0.04 = $600,000 to retire. If instead you spend $40,000 per year (or $3,333 per month), then you need $40,000 / 0.04 = $1,000,000 to retire. Be aware that this quick estimate is simplified and doesn’t take into account your specific circumstances, future social security payments, or other costs/benefits that appear later in life.

One approach I used to understand how to optimize and expedite the path to retirement is to find the most extreme cases, such as people retiring in their 30’s. You probably won’t want to follow all of the advice from these extreme cases, but they provide useful information on how you can make the most of what you’ve got. My top three blog recommendations on this are:

- Mr. Money Mustache (I recommend reading the classics first)

- The Mad Fientist (if you’re not an engineer, you might find this author’s analytic approach less engaging)

- JL Collins (his stock series articles are highly recommended)

Reducing Costs

If you’re looking to increase your savings to achieve your 4% savings target, you can either earn more or spend less. Spending less is easier because you can start doing it today.

- Don’t immediately buy from Amazon, use shopping.google.com to compare prices. eBay often has lower prices than Amazon for physical products made in China, but the quality can be lower. If you end up using Amazon, use https://smile.amazon.com to donate 0.5% of your purchase cost to your preferred charity with each Amazon purchase. There’s even web browser addons for Firefox and Chrome to automatically redirect you to smile.amazon.com so you won’t forget. If you don’t have a preferred charity, I recommend GiveWell as a good effective altruism option.

- If you are flying somewhere, check Google Flights to compare different dates and destinations. If you don’t have a destination preference, there are many travel deal sites that highlight ticket deals. One flying tip for budget airlines like Spirit, Frontier, and Allegiant is that you can often save about $20 per one way ticket per person by booking tickets at the airport counter.

- If you rent equipment for your internet or TV service from your service provider, consider buying your own equipment. It often pays for itself within 1-2 years.

- Track every dollar you spend for several months to discover what you spend on. You could find areas to reduce your costs.

Optimizing (Stock) Investing

This is one of the most important parts of personal finance, so it makes sense to spend a lot of time learning about this topic. Because investors can spend a lifetime on this topic, this information is split up into three stages.

First Steps Investing

You can get started investing with a few simple steps. First, open up an investment account with Vanguard or Schwab (my Schwab referral link). Vanguard used to be the go-to low cost option pre-2019, but Schwab has removed (nearly) all their trading fees making it my preferred option. After you have an investment account, you need to choose what to invest in. One easy investment recipe from JL Collins is to invest 80% in the stock market (ticker symbol VTI) and 20% in bonds (ticker symbol BND). You can buy more stocks if you want more risk/reward, or buy more bonds if you want to minimize your risk/reward. Buying index funds like VTI and BND is a different approach than investing in a single company’s stock, such as buying Apple stock. Instead, it diversifies your investment across a “basket” of stocks. If you buy VTI, you aren’t buying one company’s stock, but instead buying stock in every company on the stock market. This diversification reduces your risk, and it is easier to manage one index fund than manage dozens of different stocks in individual companies. One thing to be aware of is that buying “baskets” of stocks entails fees from the company creating these “baskets”. The two specific ETFs mentioned, VTI and BND, have extremely low fees. Vanguard’s ETFs are known for having some of the lowest fees around.

In addition to strategizing about your first investments, think about how much cash you want to keep on hand for emergency situations, should they arise. It can take a few days to move cash from your investment account to your bank account, so don’t get caught with too little in your bank account!

Intermediate Investing

If you’re already investing and have knowledge about the popular (AKA large market cap) index funds from Vanguard, SPDR, and others, you might be looking to level up your investing approach. One of the first considerations when reconsidering your investment allocations is to determine your risk tolerance. If you are willing to take on more risk for more potential reward, you can choose ETFs tracking higher beta indices, such as the NASDAQ or the Russell 2000. Another approach is to increase your international holdings to diversify outside of the USA’s economy.

To stay the course of your strategy, you should consider a regular asset rebalancing plan, whether that is a manual process every quarter or an automated process provided by Betterment or M1 Finance. As part of your rebalancing strategy, you could take advantage of tax loss harvesting and tax gain harvesting. Tax gain harvesting is a strategy that makes the most sense in retirement, so factoring in your estimated retirement timeline can be a factor in your rebalancing approach. Your retirement timeline will also impact the amount you invest in your retirement accounts vs. your normal brokerage accounts.

Another idea is to look beyond stocks and bonds. Is now a good time for you to consider acquiring your first piece of real estate? Would commodities or a different asset class provide a good hedge against a future market downturn? Do you want to dabble with active trading to learn more about the market? Should you find new online information sources beyond the ones you’re already familiar with? Even if you prefer to keep a solid base of index fund investments as your primary investment, it’s always good to keep expanding your knowledge about investing.

Some recommended reading for further learning includes:

- The Intelligent Investor: A classic must-read for anyone who considers themselves an investor

- What I Learned Losing a Million Dollars: many books focus on the upside of investing, but to understand more about the risk side of the risk/reward equation, read the 2nd half of this book

- A Random Walk Down Wall Street: A book explaining why beating the market is a fool’s errand

- Bogleheads forum: While some of the characters in this forum can be very strict about following standard Bogleheads investing strategies, there are some people posting creative ideas and very useful information.

- Your favorite early retirement blog(s) (or see the previous list)

Advanced Investing

If you’ve read numerous finance books, spent many hours on finance blogs and forums, and started noticing mistakes and omissions in finance articles (like the fact that dollar cost averaging is a lie), you may be looking for new ideas beyond the usual choices. There are no easy rules or approaches at this point, but increasing your knowledge will likely improve your approach and results.

- You may be familiar with the benefits of diversification, Modern Portfolio Theory, and the Markowitz Efficient Frontier, but are you properly diversifying over time? Lifecycle Investing is a thought provoking book that provides a novel argument for leveraging investments early in life to diversify or equalize your exposure to the market over your lifetime. The backtest benefits of this approach are clear, similar to how index funds are better than stock picking. The authors admit that their approach, which requires rebalancing of leverage that cannot yet be easily automated, is suited for less than 1% of the general public. I would not be surprised if this approach becomes more widespread in the next 20-30 years, similar to how index fund investing took decades to catch on in mainstream investing.

- Similar to the previous idea, take time to properly assess your

risk/reward stance to determine your ideal leverage ratio and

portfolio beta.

Unfortunately, mainstream investing resources often state

“leverage is bad” and stop there. But consider that purchasing

a house with a 20% down payment is 5x leverage, and

even the conservative Warren Buffet has used about 1.7x leverage (via insurance float) to achieve his

superior returns. There are several common ways to acquire leverage for your

investments:

- Leveraged ETFs: The easiest approach is to buy a 2x leveraged ETF (SSO, QLD, etc.) or a 3x leveraged ETF (UPRO, TQQQ, etc.). These ETFs are rebalanced daily, so if the market goes up 1%, you get (approximately) 3% returns. Many will warn of “volatility decay” and suggest daily rebalancing is not good for long term investments. However, over a short timescale such as 1 month, these ETFs track the market return with the advertised multiplier reasonably well. Examining the 10 year graph for any of these leveraged ETFs shows a more optimistic picture. Because the leveraged ETFs handle the leverage behind the scenes, you don’t need to borrow any funds yourself to acquire leverage. Downsides include about a 1% expense ratio on these ETFs, losing out on dividends, and in some cases a risk of a rare blowup (see stories about XIV).

- LEAPS: LEAPS are the suggested approach in the Lifecycle Investing book. LEAPS are a fancy acronym for long duration options. Options are a derivative that allow you to acquire nearly any amount of leverage, even up to 20x leverage. Lifecycle Investing suggests LEAPS with around 2x leverage. Like leveraged ETFs, the borrowing of funds to acquire leverage happens behind the scenes. The borrowing rate is built in to the cost of the option and can be calculated manually. Often it is best to purchase options in an asset with a large volume of options trading. This may be a different ETF than the ones you use for standard index fund investing. For instance, SPY is the most popular S&P 500 ETF for options trading, even though it doesn’t have the lowest expense ratio for normal index fund investing. Some downsides of LEAPS are that you do lose out on dividends (like leveraged ETFs), you need to roll over the option before expiry, and the amount of leverage constantly changes based on the price changes of the underlying asset. Because options are acquired in quantities of 100, the minimum contract value can be relatively high compared to leveraged ETFs.

- Futures: Futures are how leveraged ETFs acquire their leverage. Futures may have the lowest borrowing costs for leverage and more types of futures exist than leveraged ETFs (because leveraged ETFs use futures under the hood). Downsides include the possibility of margin calls(like margin accounts) and the need to roll over futures before expiry (like LEAPS). Futures are often acquired in larger quantities, but E-micro futures offer the smallest minimum contract amounts. Micro E-mini futures have a minimum contract size of 5, so with the S&P currently around 4500, the minimum contract value is $22,500.

- Margin Account: Margin accounts can have low borrowing rates if you obtain very low margin borrowing rates you can get (you will probably use Interactive Brokers). However, I dislike margin accounts because most accounts (besides IB) have high borrowing rates and margin accounts always carry the risk of a margin call. While you can hold on to some other leveraged positions during a downturn (leveraged ETFs or options) without being forced to sell, that is often not the case with margin accounts. Because you are borrowing cash from the brokerage, you must maintain a certain account balance as collateral. If your account balance drops below the margin limit level, the brokerage will liquidate your holdings in order to cover their lending position. If you happen to be on vacation during a market crash, you may end up with bad news upon returning if your position was liquidated at the bottom of the market dip.

- Real estate: This is a completely different form of leverage from the previous alternatives, but it’s worth mentioning as an alternative method of acquiring leverage. A 20% down payment is equivalent to 5x leverage, while a lower 5% down payment can provide 20x leverage. Because acquiring a mortgage relies significantly on your income and credit score as opposed to maintaining collateral in an account, you can obtain real estate leverage without significantly impacting your ability to acquire other forms of leverage.

- Cryptocurrencies offer a number of exciting features. For one, cryptocurrency markets are open 24/7, meaning time zones and banking hours aren’t problems. Additionally, it’s easier to lend out your crypto assets to generate interest, something not usually available to retail stock investors. One website enabling this is Celsius (try my referral code or promo code: 153086705d), which currently lets you earn up to 6.2% on your Bitcoin and over 8% on your stablecoin holdings (effectively cash). There are even crazier tools in the realm of cryptocurrencies, such as self-repaying loans, which open up new and exciting investment and saving strategies.

- There is no concrete recipe for generating alpha, but there are many avenues that can generate ideas. A few concrete ideas are listed here. Keeping tabs of the opinions of known macro investors is another way to keep track of big picture trends. Similarly, learning more about modern economic history, especially that of countries other than your own, can be helpful in informing your world view.

- Algo trading could be an interesting avenue for mathematically or coding inclined investors, but your mileage may vary. There’s an extensive list of open source bots for cryptocurrency trading alone.

- Depending on your circumstances, you might consider various geographic arbitrage strategies. Living in a state without state income tax or in a cheaper city is perhaps the simplest approach, but living abroad to a country with a lower tax rate, getting residency or a second passport, and other creative approaches can take this to the next level.

Credit Card Bonuses

Many credit cards offer cashback bonuses when you use them to purchase items, but you can go further. There’s an entire subculture built around maximizing the returns you can get from credit card sign-up bonuses, complete with conferences and frequent travelers flying around for (nearly) free. Even with minimal effort, you can get $2,000-$4,000 per year (tax-free, because miles and points are not taxed) by annually signing up for some new cards to get sign-up bonuses. There’s too much for me to cover on this topic in a summary, so my brief recommendation is to get the Chase Sapphire Preferred for your first card. At the time of writing, the sign-up bonus is 100,000 points, or roughly $1000+ (likely more, depending how the points are redeemed). Here’s my referral link for the Sapphire Preferred: https://www.referyourchasecard.com/6b/VBSDWJRDXW

My top recommended sites for this topic are:

- Frequent Miler gives a lot of general card advice (here’s his top cards list)

- Award Hacker lets you find the cheapest way to fly the route you want with points

- Doctor of Credit is usually an information overload, but it has good comprehensive coverage of current promotions

Meeting Minimum Spend

If your standard living costs are too low to meet the minimum spending requirement for certain credit cards, you still have options. The simplest option is to buy gift cards that you expect to use soon, such as Amazon gift cards. Another common option is to open a bank account where the first deposit is allowed to come from your credit card. This may sound strange, but there’s a long list of banks that allow this. You can open an account online, spend as much as the bank permits for the initial deposit, and then take the money out of your account before closing your account. If you’re intrigued by other cyclical ways that you can “spend” money without it actually leaving your accounts, consider reading up on chruning and manufactured spending. This is one of the best Manufactured spending guides, and there’s even a subreddit for churning if you prefer.

Minimizing Taxes

The tax code in the USA can be split into two parts: taxes for individuals and taxes for business. Most big tax breaks are designed for businesses, not individuals. I will only mention individual tax breaks. Besides special cases (buying an electric car, renewable energy credits), the most widely applicable option for reducing your taxes is using tax-deductible retirement investment accounts and itemizing your deductions. Retirement accounts are covered in detail in the next section. For itemizing your returns, this makes sense when you pay a large amount of state taxes and/or pay a lot of interest on your mortgage(s) (or fees for other investments, such as margin account interest).

Retirement Accounts

Retirement accounts are the best option most employees have to reduce their taxes. If you’re concerned that the savings you store in a retirement account will be locked away for too long before you can withdraw the savings, fear not: there are many ways to use your retirement account funds before you reach old age. You can even purchase property using a 401k.

If you are a typical W-2 employee, either your company offers a retirement plan like a 401k or they don’t. If they don’t offer any retirement account, open an IRA account with a company like Charles Schwab or Vanguard. Try to contribute the maximum annual amount to an IRA account if you can. The contribution limit in 2021 is $6,000 per year (or $7,000 per year if you’re over 50). The money you contribute to an IRA is tax-free income, which will show up as a tax refund when you do your taxes the following April.

If your company does offer a retirement plan, that’s great! If company matching is available, be sure to use that fully. The maximum annual tax deductible amount that can be contributed to your 401k is $19,500 in 2021, but you can contribute more than that amount if you are planning on a mega-backdoor Roth.

HSA

Whether or not your company offers a retirement account, you should check whether the health insurance coverage your company provides makes you eligible for an HSA. Surprisingly, an HSA is actually the best tax-free retirement account. Unfortunately the maximum contribution of $3,600 per year for individuals in 2021 (or $7,200 for families) is lower than other retirement account options. You don’t need to withdraw funds from your HSA at the same time that you spend on eligible expenses. If you keep your receipts, you can withdraw an equivalent amount from your HSA in the future (after it has appreciated in value).

Optimizing Returns on Cash

Given the drop in interest rates in 2020-2021, you can do better than the near-zero returns you get from your local bank’s savings account.

- 7-12% returns: Cryptocurrency stablecoins offer a way to earn high interest on what is effectively digital cash. You can convert your cash to a stablecoin like USDC or Dai, which should stay at a 1-to-1 value with US dollars, and you earn 7-12% interest with services like BlockFi. I prefer BlockFi or HODLnaut for stablecoins (BlockFi provides 9% yields and HODLnaut 12%) while I use Celsius or HODLnaut for other crypto assets like Bitcoin or Ethereum. Here’s my BlockFi referral code if you decide to sign up: https://blockfi.com/?ref=88af3886 and my Celsius referral code: https://celsiusnetwork.app.link/153086705d (or promo code: 153086705d). and my HODLnaut referral code: https://www.hodlnaut.com/join/8So3LjM-K As another option for those new to crypto Gemini might be the easiest option to earn high stablecoin interest (7.5%) because you can deposit your fiat directly from your bank account to Gemini, which isn’t an option for any of the other options I mentioned. 7-12% returns are pretty hard to beat, especially because there is no fee to buy these tokens (like there is with some other cryptocurrency). Obviously there’s risk because crypto is still new, but these tokens should stay equal in value to the dollar. The best return rates are listed at defirate.com.

- 5% returns (or the current inflation amount): You could invest in TIPS (treasury inflation-protected securities), which are some of the safest investments in the world because they’re backed by the US government (like the US dollar is). Unlike storing your money in cash, TIPS increase in value with inflation. This helps make sure that your one dollar today is still worth one dollar in ten years time, because the value of TIPS increase at an inflation-adjusted rate. There are many ETF tickers for TIPS, but TIP and SCHP are two of the largest by market cap. The returns from TIPS will vary based on inflation, so it is unlikely to remain a constant 5% every year. TIPS do have some nuances that impact returns.

- 3-7% returns: A slightly riskier option is to buy bonds. I won’t give any specific ETF suggestions here because there’s so many options (corporate bonds, government bonds, etc.). Corporate bonds have higher returns but also higher risk, because corporations are more likely to go bankrupt than governments. Bonds haven’t been doing well in 2021, and with current inflation and interest rate tension, bonds are unlikely to be the best option in 2021-2022.

Healthcare Costs

Healthcare costs in the USA are opaque, hard to understand, and usually higher than they should be (though that may slowly change). If you are employed and are using employer-provided healthcare, you may not need to worry about healthcare plans because the choice is made for you. However, for those who are not employed or are not covered by an employer-provided plan, it’s a difficult question to solve. With the average US monthly health insurance plan costing around $400-$500, the question is whether this cost is worthwhile. I have not found a good solution to this problem, but if you are young and easily able to travel, consider geographic arbitrage (or medical tourism) to receive medical care abroad in the event that you need it. Another option is to choose catastrophic health insurance, which has a lower monthly cost with a higher deductible. Catastrophic health insurance is probably only a good choice for those in good health and with substantial savings for medical emergencies. Another option is Direct Primary Care (DPC), which is explained in this post. No doubt there are additional lesser known alternatives hidden in relevant forums or subreddits.

Buying Cars

When buying a car, aim for something on the low end of the price range. A car depreciates as you use it, and therefore is not an investment. Due to the slimmer profit margins that auto manufacturers make on their smaller, cheaper cars, I think those cars provide better value. A new car from any well-known manufacturer is a fine choice, but if you trust your car knowledge (or know someone who you can trust), getting a low mileage used vehicle under 5 years old is a better value choice than buying a brand new car.

Buying Real Estate

Real estate is usually the most expensive purchase of your life. I don’t know much about real estate, but if you are planning to live in a single location for over 5 years, I think buying is a better strategy than renting unless you’re in an overpriced city like Los Angeles, San Francisco, New York City, Boston, or similar. However, while you’re young, it makes sense to rent to remain open to new career opportunities in new locations.

If you already have a fixed-rate mortgage on a property and mortgage rates have dropped since you first got the mortgage, you can refinance your mortgage and reduce your monthly mortgage cost.

Healthy Eating

Of all the items in this list, I have observed that people have the most resistance to being told what to eat. I prefer a vegetarian or vegan diet because it works for me, even when I trained for and ran a marathon. I like the reduced environmental impact of eating plants and my body feels better without meat. If you’re not convinced, at least consider that our closest genetic relatives, chimpanzees, are primarily vegetarian and are fed fruit in zoos.

Besides food, I believe that the majority of people don’t drink enough water throughout the day. Drinking more water (and avoiding other beverages, except maybe tea and coffee) is something that everyone should try to see whether they notice any benefits. There’s no real downsides to this.

Sleep

My bag of tricks for getting good sleep includes:

- Make the room as dark as possible at night. Unplug electronics with LEDs and use blackout curtains on the windows.

- Because disabling all LEDs is hard, I use this sleep mask, which is much more effective and comfortable than the free ones you get on airplanes.

- If your bedroom is not in a quiet location, I recommend going all-out and using both earplugs and a white noise machine. I prefer these 3M earplugs and the Marpac Dohm Classic white noise machine.

- Get a good pillow and a good mattress. You spend years of your life asleep, so it makes sense to invest wisely to get the most out of those years of rest!

Tech Security & Privacy

Because my interest in this topic led me to a new career path, I have so many thoughts on about this that it deserves its own website. Passwords are the primary security weak point, so please aim for at least the bare minimum:

- Don’t reuse passwords on multiple sites

- Use secure hard-to-guess passwords (ideally pseudorandomly generated)

- Set up 2-Factor Authentication (2FA) on all important finance accounts

Clothing

Clothing designed for outdoor sports often uses materials with special properties not often found in standard clothing. I like this site for reviews on multipurpose clothing, useful for everyday and outdoor use. As a starting point, I suggest getting a pair or two of merino wool socks to test out whether fast-drying and odor-resistance material is something you find useful in your wardrobe.

Death Planning

Death is a taboo topic for discussion in the USA, but ironically it is the one life event that is guaranteed. Therefore, I think it makes sense to plan ahead for this eventuality, regardless of your age.

First Steps Death Planning

Contrary to popular belief, you don’t necessarily need to make a will. The goal of a will is to avoid probate, which is a costly and lengthy legal process to distribute the assets of a person who died and did not leave proper instructions for asset distribution. However, there’s more than one way to avoid probate. Using a will makes the legal process easier if you have complicated assets to distribute, but the average person can manage just fine by avoiding lawyers and court completely by setting beneficiaries for each individual asset. To go this route, start by setting beneficiaries for the most easily transferred assets, your online financial accounts. Login to all of your financial accounts and set beneficiaries for your accounts. You can do this online for most investment and retirement accounts, but you may have to visit your bank in person to set a beneficiary for your checking or savings account. After you’ve put in all this effort, be sure that your beneficiaries have a copy of your account numbers and basic account information so they can properly transfer the assets if you suddenly pass. Creating a set of instructions for them may also be helpful. If any benefits you receive (life insurance, Social Security, pension, union benefits, or other) are transferable to surviving family, make sure they know about this.

Intermediate Death Planning

If you have physical assets, such as a car or a house, setting beneficiaries can take more effort.

For vehicles, investigate whether your state allows a vehicle to be jointly titled in your name and your beneficiary’s name with “rights of survivorship”. Some states don’t yet have a way to do this, but you can research your state’s laws on this topic. Often states make it fairly easy to transfer vehicle ownership on death between family members.

For real estate, you have a few options. A few states have what is called a “lady bird” deed, while others have a transfer on death deed. Check if your state allows for one of these options. If you live in a state that does not yet have such an option, you could try reaching out to your state’s government to push the idea, check for ongoing legislature that might implement this type of option, or settle for using a will.

Again, make sure that your beneficiaries are given copies of the deeds and other asset information so they can transfer the assets should you pass.

Advanced Death Planning

After you have determined beneficiaries for your assets with intrinsic value, there’s still more to be done.

You should get the proper healthcare documents completed to avoid costly medical treatment prior to death. The majority of US healthcare spending occurs in the final year of life, and debates exist around whether these costs are well spent. You can have more control over such situations and avoid leaving expensive medical bills for your family by preparing in advance. Some forms that fall into the “advanced care planning” category include healthcare directives (AKA advance directives), healthcare power of attorney, and POLST. Templates for these forms are online so you may not need a lawyer to complete them.

You should plan how your digital assets should be handled. Some websites allow you to configure things in advance of the account holder’s death, but this is not commonly found outside of some of the most popular websites. You might create a backup of your login credentials along with instructions for each account so your beneficiaries can handle things after your passing.

Random

- You can visit some museums for free if you have a Bank of America credit/debit/HSA card using the Museums on Us program.

- If you are a member of some museums, gardens, or associations, you can sometimes get free entrances into other partner locations. For instance, if you are a member of a botanical garden that is a part of the American Horticultural Society Reciprocal Admissions Program, you can enter any other garden in the program for free.

- Another way to visit museums on the cheap is to check your local library. They often have passes for nearby museums for museum patrons to use, providing either free or discounted entry to nearby residents.

- Some credit cards or companies provide a Priority Pass, which provides access to airport lounges. For frequent travelers, airport lounges can provide a quieter location to wait for your next flight and amenities such as free food, showers, and more.

- State and National Parks often have free entry days. You can also get an annual pass for a reasonable price if you are a frequent visitor.